Amid the COVID-19 pandemic, many of us have transitioned to working and socializing from home. If these trends become the new normal, certain companies could also be in for an enormous payoff.

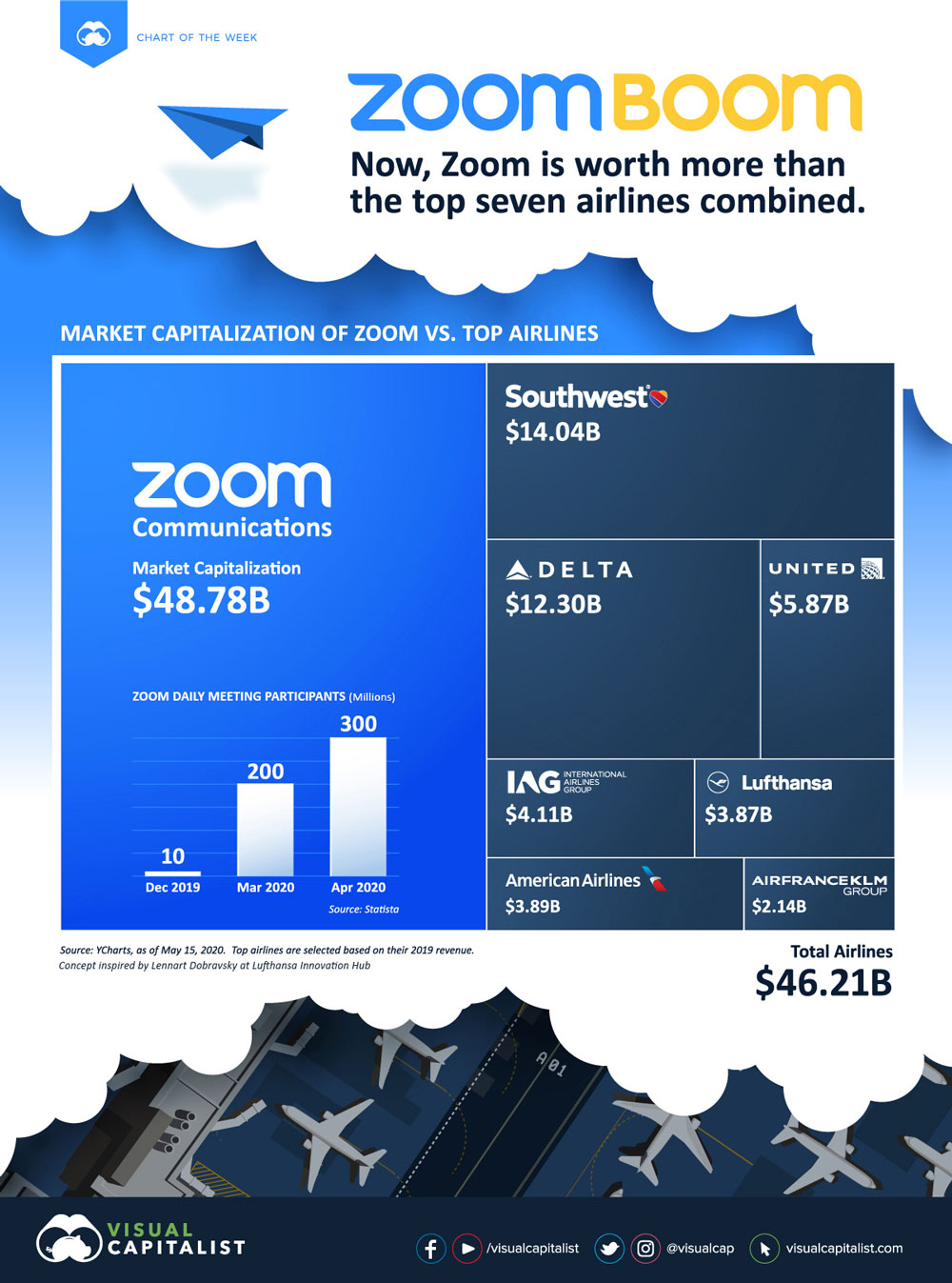

Popular video conferencing company, Zoom Communications, may be a prime example of a corporation taking advantage of this transition. Today’s graphic, inspired by Lennart Dobravsky at Lufthansa Innovation Hub, may be a dramatic check out what proportion Zoom’s valuation has shot up during this unusual period in history.

The Zoom Boom, in Perspective

As of May 15, 2020, Zoom’s market capitalization has skyrocketed to $48.8 billion, despite posting revenues of only $623 million over the past year.

What separates Zoom from its competition, and what’s led to the app’s massive surge in mainstream business culture?

Industry analysts say that business users are drawn to the app due to its easy-to-use interface and user experience, also because of the ability to support up to 100 participants at a time. The app has also blown up among educators to be used in online learning after CEO Eric Yuan took extra steps to make sure K-12 schools could use the platform for free of charge.

Google and Facebook direct employees to work from home til 2021

Zoom meeting participants have skyrocketed in past months, going from 10 million in December 2019 to a whopping 300 million as of April 2020.

The Airline Decline

The airline industry has been on the other end of fortune, suffering an unprecedented plummet in demand as international restrictions have shuttered airports:

The world’s top airlines by revenue have fallen in total value by 62% since the top of January:

| Airline | Market Cap Jan 31, 2020 | Market Cap May 15, 2020 |

|---|---|---|

| Southwest Airlines | $28.440B | $14.04B |

| Delta | $35.680B | $12.30B |

| United | $18.790B | $5.867B |

| International Airlines Group | $14.760B | $4.111B |

| Lufthansa | $7.460B | $3.873B |

| American | $11.490B | $3.886B |

| Air France | $4.681B | $2.137B |

| Total Market Cap | $121.301B | $46.214B |

With countries scrambling to contain the spread of COVID-19, many airlines have cut travel capacity, laid-off workers, and chopped executive pay to undertake and stay afloat.

If and when regular aviation will return remains a serious interrogation point, and even patient investors like Warren Buffett have pulled out from airline stocks.

| Airline | % Change in Total Returns (Jan 31-May 15, 2020) |

|---|---|

| United | -72.91% |

| International Airlines Group | -72.16% |

| American | -65.76% |

| Delta | -65.39% |

| Air France | -54.34% |

| Southwest Airlines | -56.35% |

| Lufthansa | -48.08% |

What Does The Future Hold?

Zoom’s recent success may be a product of its circumstances, but will it last? That’s an issue on the mind of the many investors and pundits before the company’s Q1 results to be released in June.

It hasn’t been all smooth-sailing for the company—a spate of “Zoom Bombing” incidents, where uninvited people hijacked meetings, brought the app’s security measures under scrutiny. However, Zoom remained resilient, swiftly providing support to combat the matter.

YouTube announces $5mn Grant To Pakistan Cause of Coronavirus epidemic

Meanwhile, as many parts of the globe begin taking measures to restart economic activity, airlines could see a cautious return to the skies—although any such recovery will surely be a “slow, long ascent”.

Article and infographic republished from the Visual Capitalist.